Pricing Risks in Tangible and Intangible Capital: Implications from a Two-Sector Economy

This paper builds a two-sector DSGE model in continuous time, where two sectors are subject to risks of different persistence.

This paper builds a two-sector DSGE model in continuous time, where two sectors are subject to risks of different persistence.

Building a DSGE model in continuous time featuring heterogeneous agents and multiple sectors, this paper demonstrates the impact of financial frictions on the capital reallocation.

This paper studies a general equilibrium model with heterogeneity in both risk aversion and beliefs about the expected growth rate of the aggregate endowment.

We extend the heterogenous agent models in macroeconomics to consider recursive preferences and asset pricing in continuous time framework.

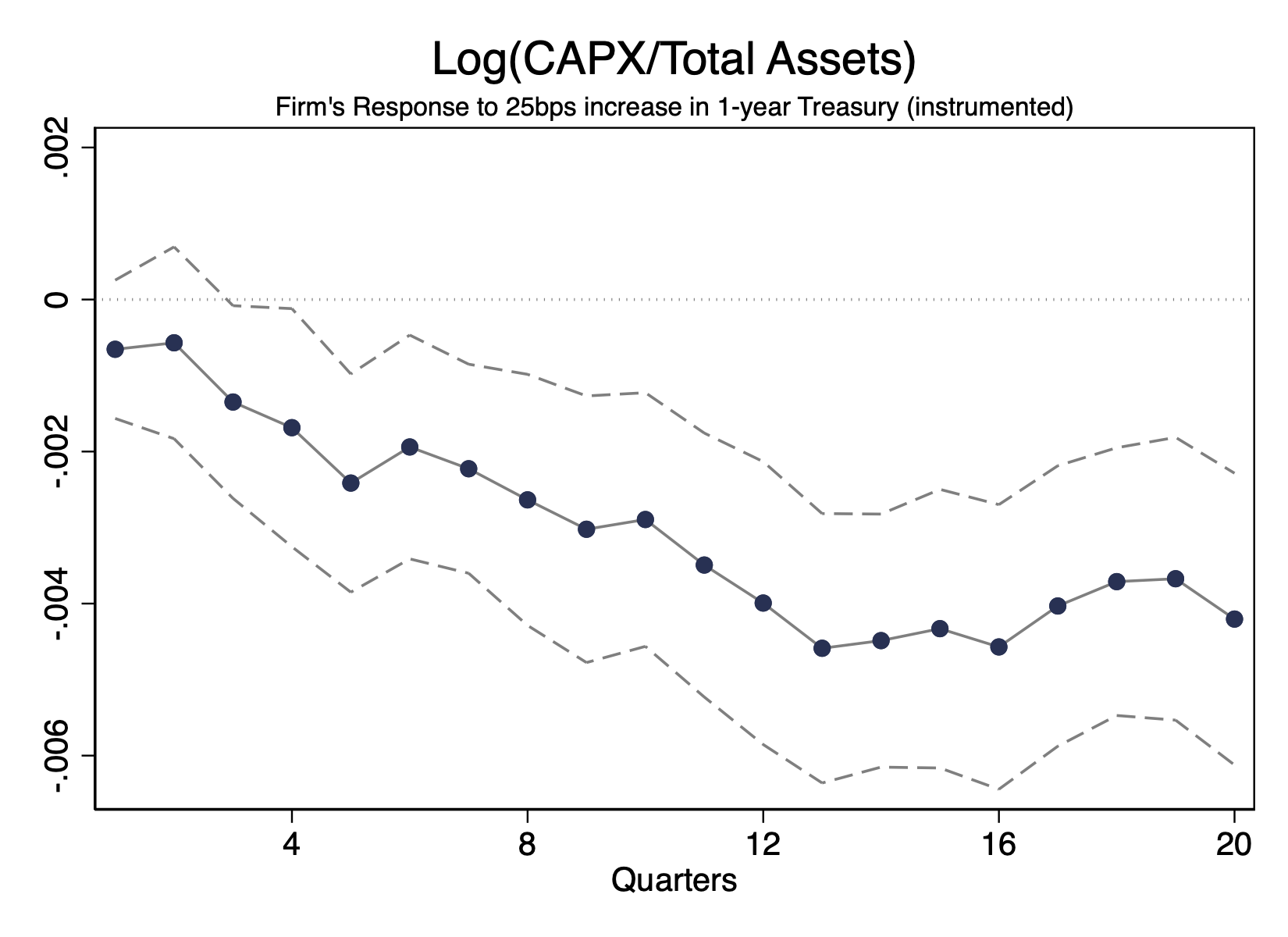

This paper highlights the role of the equity financing constraints in the transmission of monetary policy.